Invest In Corporate Bonds And Other Debt Securities

With inflation easing and interest rates beginning to cool, income-generating assets are well-positioned to deliver stable returns while offering a lower-risk opportunity to grow wealth.

Earn better returns, with less fees using corporate bonds and other debt securities.

A debt security is a financial instrument where an investor loans money to an entity—such as a government, corporation, or other organisation—in exchange for periodic interest payments and the return of the principal amount at the end of the term.

And at ABE, you can get started for as little as $10,000.

You get better returns than many other investments. Avoid high risk hybrids. With much safer and stable returns than stocks or funds.

Direct Benefit to You

Right now, a wide range of debt securities, including high-yielding Australian corporate bonds and global companies, are available to investors like you.

- Protecting your capital while you help it grow

- Avoid hidden fees which means you keep more of your investment returns

- Have complete control over your investments

- Freedom from paying fund managers that don’t outperform robots and roboadvisers

- Bring comfort and certainty into your portfolio

- Avoid highly speculative investments that put your money at risk

- A liquid high yield investment that offers diversity and balance

- Most of all, enjoy your future without having to worry about your income

This means you can now invest directly, bypassing complex products from large institutions and funds that you may not understand, and avoiding hidden fees, commissions, and additional costs.

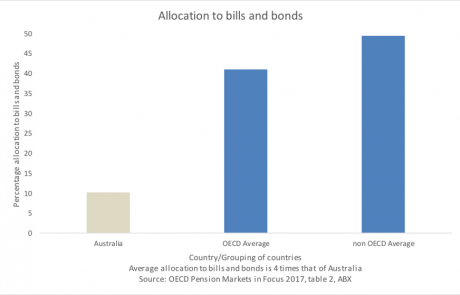

Compare Your Investments with the World Average

Australians are generally underrepresented when it comes to bond and debt market investing. While we’re passionate about shares and property, the recent market fluctuations highlight the risks involved. The graph below illustrates how bonds are regarded globally as a crucial third pillar of investment.

The main reason for the much higher use of bonds is their security, capital preservation and regular returns. They balance the riskier asset classes like stocks and property.

You can now gain full control and trade a much smaller trade size than previously available, direct to the market at wholesale prices. Bring your investments into line with the rest of the world and defend against market corrections.

Enter your contact details below and we’ll send you information on how bonds can be used for consistent income investments.